Applications of 6N High-Purity Copper in Semiconductors

Sep 15, 2025In the fast-paced semiconductor industry, where precision and performance define success, 6N high-purity copper (99.9999% pure) emerges as a critical material. As of September 2025, with AI-driven computing, 5G/6G networks, and electric vehicle (EV) chips surging in demand, 6N copper's role in enabling ultra-low resistance interconnects and high-efficiency devices has never been more vital. This alloy minimizes impurities that could cause defects, ensuring reliability in nanoscale fabrication. As global semiconductor sales hit $600 billion this year, driven by advanced nodes like 2nm processes, 6N copper is fueling innovations from quantum bits to power modules.

6N copper is essentially elemental copper refined to extreme purity levels, with impurities below 10 parts per million. Produced via advanced methods like continuous casting-electro winning (CURE) or zone refining, it achieves conductivity near the International Annealed Copper Standard (IACS) value of 101%. Its key properties include exceptional electrical conductivity (up to 59 MS/m), thermal conductivity (around 400 W/m·K), and low softening temperature, making it ideal for high-temperature annealing without deformation. Density sits at 8.96 g/cm³, with a melting point of 1085°C. Unlike lower-grade coppers, 6N variants exhibit negligible oxygen content (<5 ppm), reducing oxidation risks in vacuum environments and enhancing ductility for thin-film deposition.

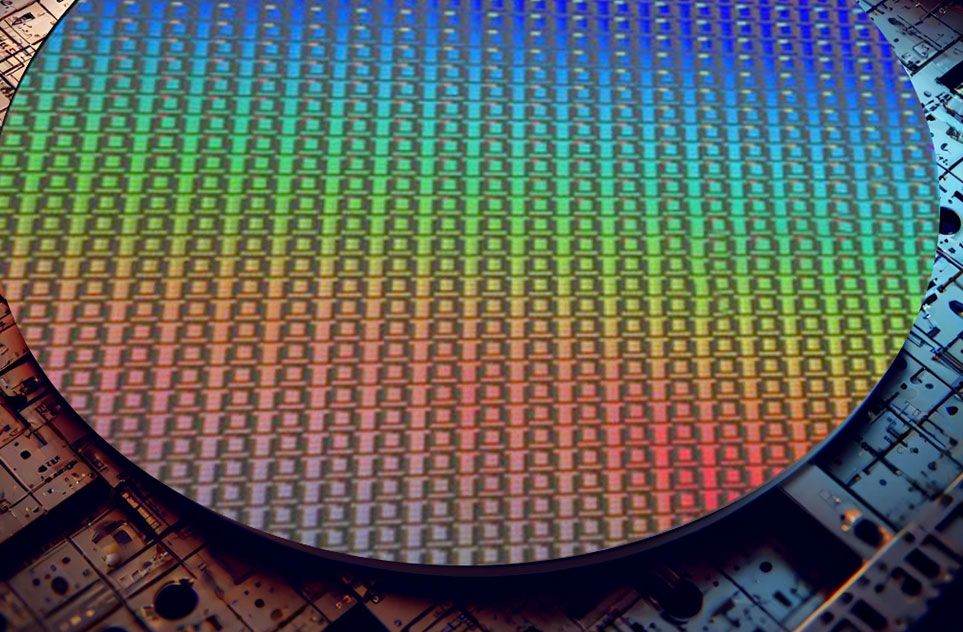

6N copper shines in several semiconductor processes. Primarily, it's used as sputtering targets in physical vapor deposition (PVD) for copper interconnects in logic chips and memory devices like DRAM and NAND flash. This application reduces electromigration and voiding, critical for sub-5nm nodes. In electroplating, 6N copper anodes ensure uniform damascene filling, boosting yield in high-volume manufacturing at fabs like TSMC and Intel.

Beyond interconnects, it's integral to RF components, where low signal loss supports 6G base stations, and in power semiconductors like SiC-based IGBTs for EVs, providing robust thermal management. Emerging uses include superconducting qubits in quantum computing, leveraging its cryogenic stability, and advanced packaging like 3D stacking in AI accelerators. These applications underscore 6N copper's versatility in scaling Moore's Law while addressing power density challenges.

The high-purity copper market is booming in 2025, valued at approximately USD 21.94 billion globally, up from USD 21.06 billion in 2024, with a projected CAGR of 4.5% through 2033, reaching USD 30.5 billion. Semiconductor demand, accounting for over 40% of usage, is propelled by EV adoption and AI data centers, with Asia-Pacific leading at 55% market share due to expansions in China and Taiwan. Ultra-pure segments, including 6N, are growing faster at 6-7.5% CAGR, driven by sputtering targets valued at USD 1.5 billion this year.

Challenges include supply chain volatility from mining disruptions in Chile and Peru, pushing prices to $10,000/ton amid U.S. CHIPS Act investments totaling $52 billion for domestic production. Sustainability trends favor recycled 6N copper, reducing carbon footprints by 80%, while innovations in recycling tech address e-waste from electronics. Geopolitical tensions, like U.S.-China trade frictions, are accelerating diversified sourcing, benefiting suppliers in Europe and Japan.

In summary, 6N high-purity copper remains indispensable for semiconductor advancements in 2025, bridging performance gaps in an electrified world. As markets evolve, strategic adoption will define competitive edges.