Current Domestic and International Analysis of High-Purity Copper in 2025

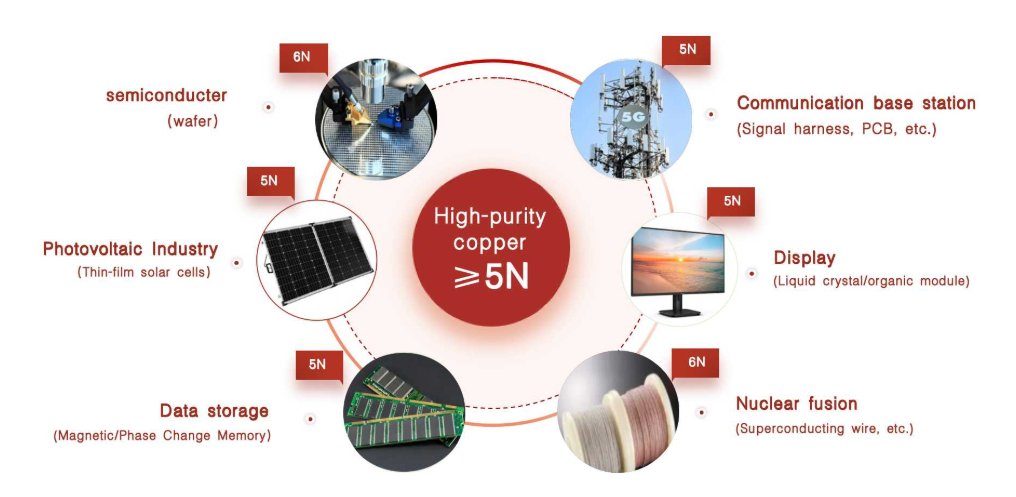

Sep 19, 2025As of September 2025, high-purity copper (HPCu), with purity levels of 99.9999% or higher (6N and above), remains a cornerstone material in electronics, semiconductors, and renewable energy sectors. Its superior conductivity and minimal impurities make it essential for advanced applications like chip interconnects and EV batteries. Globally, the HPCu market is valued at USD 21.94 billion this year, up from USD 21.06 billion in 2024, with a projected CAGR of 4.5% to reach USD 30.5 billion by 2033. However, supply-demand imbalances and geopolitical tensions are reshaping dynamics, particularly in China—the world's largest producer—and international markets.

Internationally, HPCu demand is surging due to the green energy transition and AI boom. The International Energy Agency (IEA) forecasts global copper demand to hit 28 million metric tons by year-end, a 3% annual rise, driven by EVs and data centers. Yet, supply lags: refined copper output grew only 3.3% in Q1 2025, creating a 233,000-ton surplus early on but signaling deficits ahead. The IEA warns that by 2040, demand could outstrip supply by 40%, necessitating 80 new mines worldwide. Prices reflect this volatility, with copper at USD 4.54 per pound on September 19, up 6.45% year-to-date, amid mining disruptions in Chile and Peru.

In North America and Europe, U.S. CHIPS Act investments ($52 billion) boost domestic HPCu for semiconductors, while Europe's focus on recycling cuts carbon footprints by 80%. Scrap prices are trending upward, with global spreads widening due to energy costs. J.P. Morgan cautions a demand slowdown in H2 2025 from front-loading, potentially easing prices but straining high-end HPCu availability for quantum and RF tech.

China dominates, accounting for nearly 60% of global refined copper output, projected to grow 7.5%-12% in 2025 despite feedstock shortages. However, September production dipped 4-5% month-over-month due to tax changes and real estate slowdowns, curbing demand. High-end applications like 5G and photovoltaics are reshaping the sector, with CCIE 2025 highlighting copper alloys' role in EVs and smart grids. Asia-Pacific holds 55% of the HPCu market share, fueled by expansions at TSMC and Samsung fabs. Yet, trade frictions with the U.S. accelerate diversified sourcing, pushing Chinese firms toward sustainable refining.

Challenges include concentrate shortages, with smelters like Jiangxi Copper scaling back. Positively, innovations in zone refining enhance 7N purity for export, supporting China's "Made in China 2025" push.

In 2025, HPCu's trajectory hinges on balancing supply deficits with tech-driven demand. Internationally, expect tighter regulations on ethical sourcing; domestically, policy shifts could stabilize output. For manufacturers, securing reliable suppliers is key to navigating volatility.

Discover premium high-purity copper solutions at Dysen Industrial to meet your needs.

In conclusion, while opportunities abound in electrification, proactive hedging against shortages will define success in this critical market.